What is the Labor Department thinking?

The U.S. Department of Labor (DOL) just rescinded 2022 guidance that discouraged fiduciaries from including cryptocurrency options, such as bitcoin, in 401(k) retirement plans. DOL said that it was just taking the agency’s thumb off the scale and was “neither endorsing, nor disapproving of” fiduciaries who decide to include crypto options on their 401(k) menu. But, come on, why would DOL go to all this trouble if not to boost the inclusion of bitcoin and other cryptocurrencies in 401(k)s accounts?

Bitcoin in 401(k)s is a terrible idea. Participants don’t understand the product, it’s a speculative and volatile investment, straying from traditional investments is unlikely to enhance returns, and it’s probably not a prudent option for 401(k)s.

A lot of hype – and confusion

Bitcoin receives a lot of hype, but people don’t understand what it is. It is a weird product. It is a form of digital currency that uses blockchain technology to support transactions between users, but that currency also has a value that appears to fluctuate significantly. Warren Buffett famously said he wouldn’t buy all the bitcoin in the world for $25. Bitcoin doesn’t produce any cash flow, so it doesn’t generate any returns for the investors. The only way investors can generate a profit is to sell it back for a higher price. It’s much more like gambling than a productive investment.

For some that gambling has paid off (see Figure 1). But it’s been a wild ride. And it’s not clear where it goes from here.

You could do better in an index fund

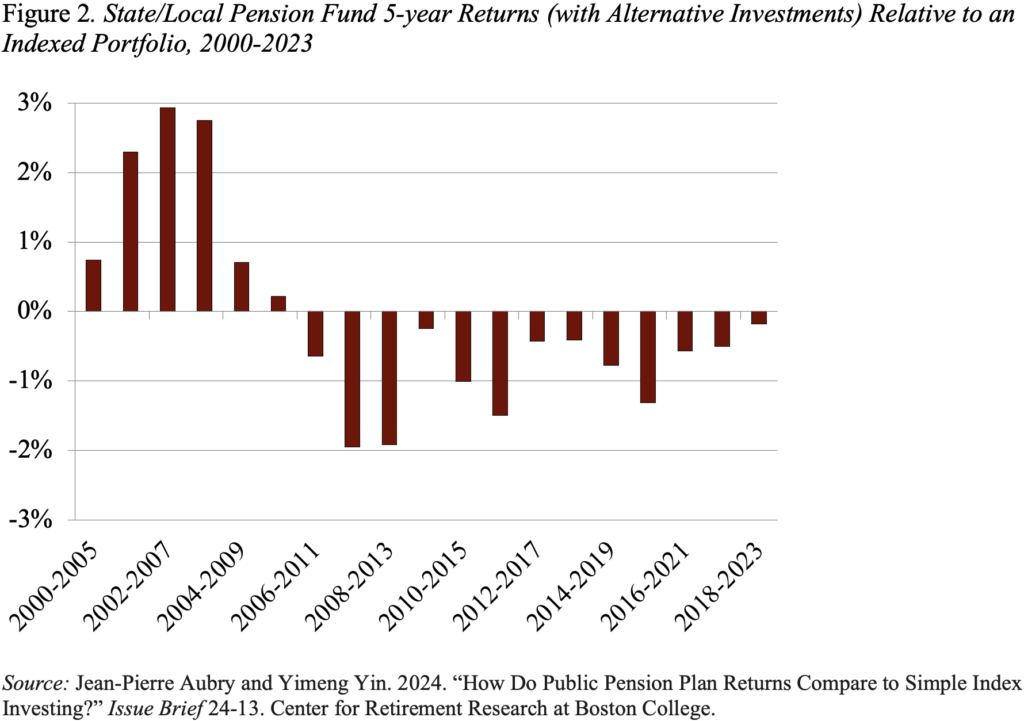

What is pretty clear, however, is that moving away from traditional stocks and bonds does not necessarily lead to higher returns. Several studies have looked at the investment performance of state and local pension plans, which have increasingly shifted from traditional assets to alternatives, such as private equities, hedge funds, real estate, and commodities and compared that performance to returns from a hypothetical indexed portfolio of 60 percent stocks and 40 percent bonds. Research has found that public pensions could get higher after-fee returns by investing in the passive index fund. The most comprehensive assessment, which finds no gains from alternatives over the entire period from 2000 to the present, shows large shortfalls since the global financial crisis. In short, no evidence exists that exotica produces higher returns, and it could well hurt.

Too risky for 401(k) plans

Finally, at least one expert argues that on legal grounds bitcoin should not be offered in 401(k)s at this time. To satisfy ERISA’s fiduciary standards, the threshold consideration is the general acceptability of the asset class to a broad group of investors. In this case, the most relevant broad group of investors would be the trustees of defined benefit plans. Most defined benefit plans do not invest in bitcoin. And 401(k) trustees should be more cautious in terms of investments than trustees of defined benefit plans. Defined benefit plans involve large piles of capital managed by professional fiduciaries with long time horizons; 401(k) plans involve small accounts managed by unsophisticated investors with shorter time horizons. It makes no sense to offer an asset class to 401(k) participants before it has been accepted by the professional trustees of defined benefit plans.

In short, adding bitcoin to the menu of 401(k) plans is not prudent, it introduces unnecessary risk, and it is unlikely to improve returns. DOL should not be opening the door to this type of activity. The agency should be protecting 401(k) participants, not putting retirements in play.