Simplify Onboarding, Speed Up Workflows

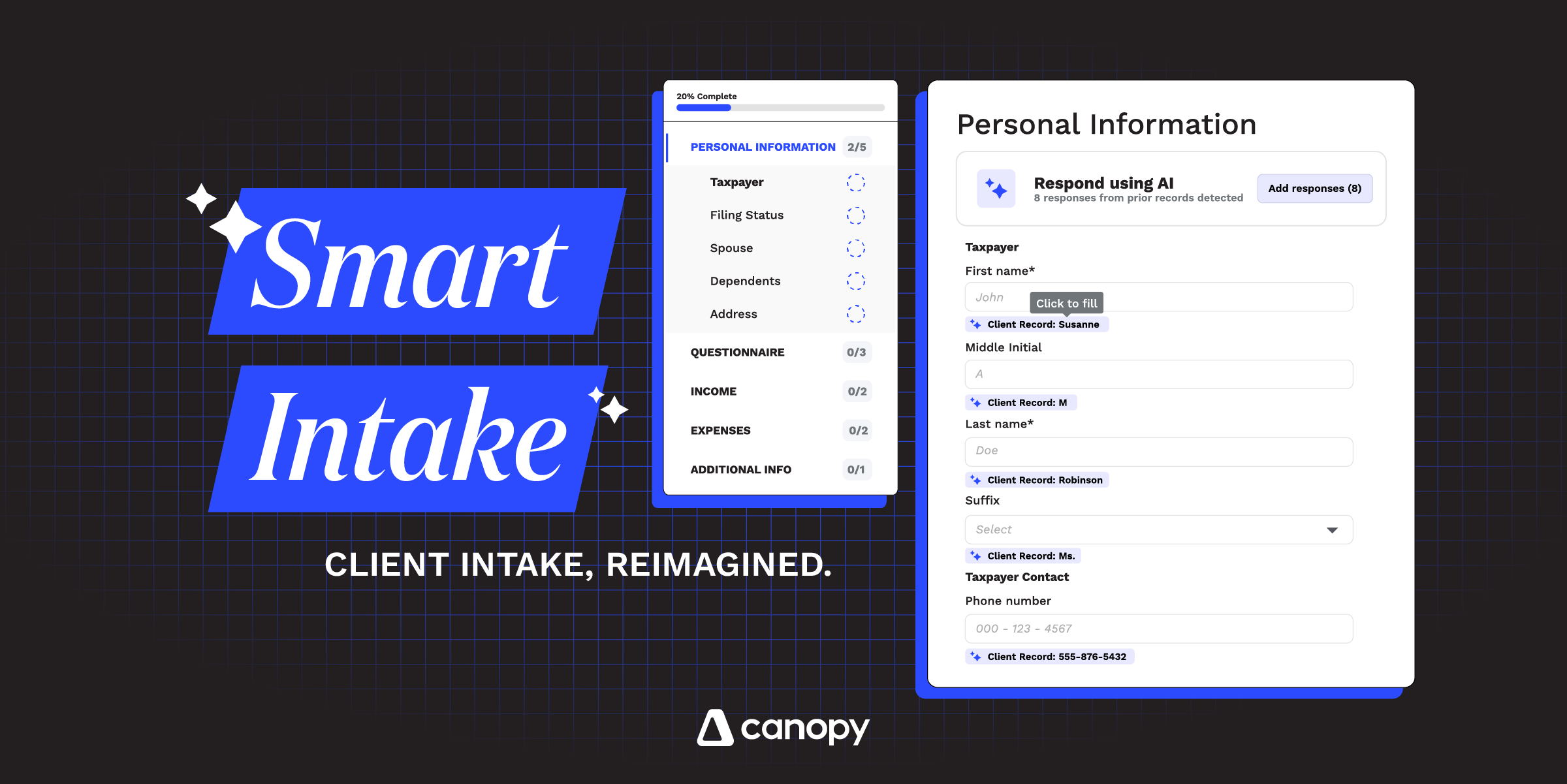

We’ve officially launched Smart Intake, the next evolution of client onboarding for modern accounting firms. Built to eliminate bottlenecks and cut admin work by hours, Smart Intake transforms the way you collect, organize, and store information— so you can get to work faster and deliver a world-class client experience from day one.

Why Smart Intake?

Intake is one of the most painful, inconsistent processes in accounting firms. Gathering documents, sending reminders, tracking progress — it eats away billable hours, delays projects, and creates frustrating starts to engagements. Smart Intake automates the heavy lifting so you can get what you need, when you need it, without the manual chase-down.

With AI-powered document classification, smart questionnaires, pre-filled fields, automated reminders, and seamless client interactions, Smart Intake turns a time-consuming process into a streamlined, client-friendly experience.

Not to mention the fact that it’s all in the same software as your document storage, CRM, and billing. There’s no need to worry about broken or light integrations, multiple client portals, or difficulty finding information.

What’s New?

- AI-Powered Document Renaming & Classification: Automatically rename and categorize incoming documents using global firm rules — no more manual sorting.

- Questionnaires & Pre-fill responses: Build questionnaires from templates and allow clients to respond with AI. Speed up the process of data collection and increase client satisfaction with pre-populated answers that clients can check and change as necessary.

- Seamless Client Experience: Clients can upload documents, fill out forms, receive reminders, and save progress via our popular Canopy Client Portal or via secure links — no logins required.

- Predictive Document Request Lists (Coming Soon): AI-suggested document request lists and questionnaires based on prior returns or prompts for a single information collection experience.

The Impact

Smart Intake eliminates manual efforts, so you can focus on the work, not the chase.

- Faster Onboarding: No more chasing paperwork or waiting weeks to start projects.

- Happier Clients: A smoother first impression that sets the tone for great service.

- Fewer Admin Hours: Free up your team’s time by removing intake roadblocks.

- Better Data Integrity: Pre-filled forms and auto-classified documents reduce errors from day one.

Explore Smart Intake Today

Smart Intake is now live in Canopy. Start automating your onboarding and transforming your client experience.

Want a walkthrough? Check out the interactive demo.