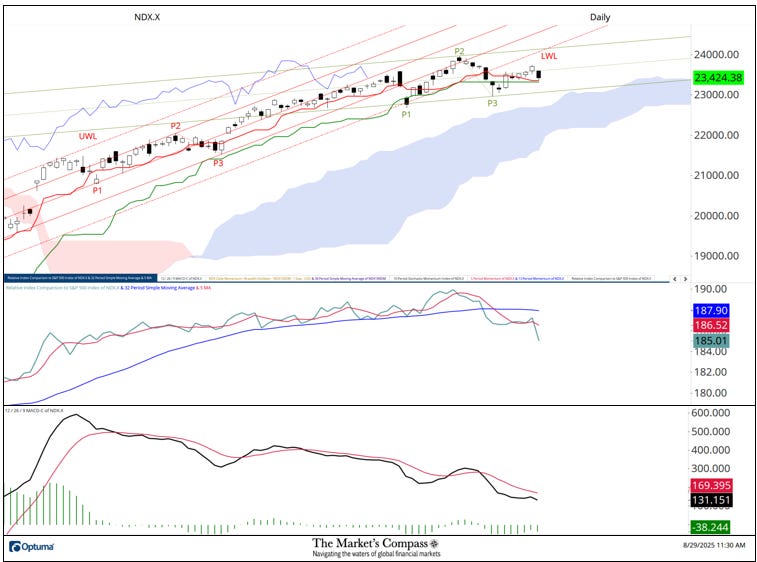

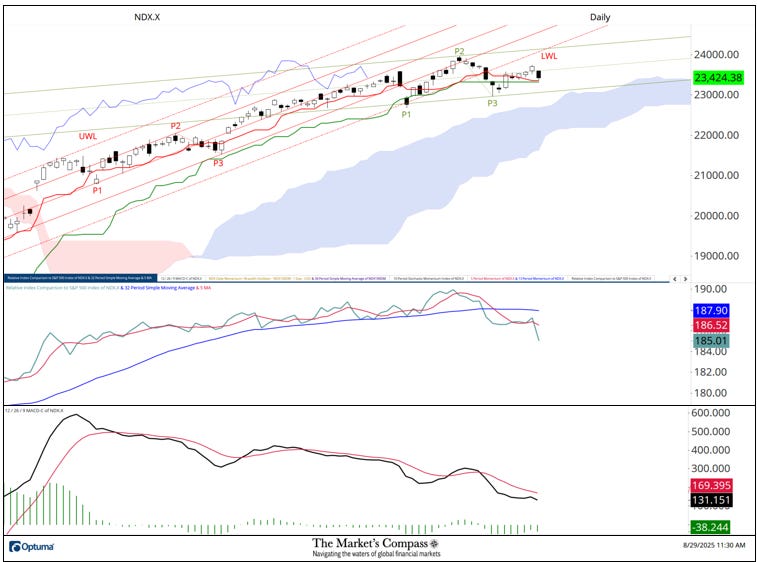

In my Substack Blog post published a week ago, last Wednesday, I stated that there were several technical factors, as the title suggested, that there was potential “Early Signs of a Crack in the Back of the Nasdaq 100 Index’s Rally”. My only concern at that time was that I was sticking my neck out with that warning, considering that over the remainer of the week there was a few potential news events that could invoke volatility in the rates market that would likely overflow into the equity markets. That proved to be a reasonable concern, and my technical thesis was promptly “Jackson Holed” last Friday and investors were caught “wrong sided” and equities, including the NDX Index rallied sharply. In doing so it retook the ground back above the broken Kijun Plot (green line) There was a measure follow through over the rest of the week until today. That five-day rally from a week ago last Wednesday’s low could not even begin to challenge the Lower Warning Line (red dashed line) of the longer-term Standard Pitchfork (red P1 through P3).

I drew a shorter-term Schiff Pitchfork (green P1 though P3) after last Friday’s rally that encompasses what I think is a distributive top. Note the continued Relative underperformance vs. the SPX in the lower panel. Below that, MACD only briefly stabilized but has turned lower again (note histogram in green) and remains below its signal line. I now mark first support at the Lower Parallel of the new Schiff Pitchfork and second remains at Cloud Support. Note that the Cloud is no longer mirroring the vector of the longer-term Standard Pitchfork. My technical thesis of that we are witnessing a distributive top will be negated with a rally that is able retake the ground above the Lower Parallel (red LWL) and the August 13th price pivot at green P2

Chart is courtesy of Optuma