Gold’s record-breaking rise continued on Friday (September 5), with the price approaching US$3,600 per ounce.

After spending the summer months consolidating, the yellow metal began breaking out this week. It pushed through US$3,500 on Tuesday (September 5) and then kept rising, coming within less than a dollar of US$3,600 on Friday.

Gold price chart, August 29, 2025, to September 5, 2025.

Chart via the Investing News Network.

Expectations that the US Federal Reserve will lower interest rates when it meets later this month are part of what’s driving gold’s move. The central bank hasn’t made a cut since December 2024, but comments made by Fed Chair Jerome Powell in a recent Jackson Hole, Wyoming, speech stoked anticipation among market participants.

US jobs data for August, released on Friday by the Bureau of Labor Statistics (BLS), has essentially locked in a downward move in rates. Nonfarm payrolls were up by 22,000, significantly lower than the 75,000 expected by economists.

Meanwhile, the country’s unemployment rate came in at 4.3 percent.

The report is the first to be released since US President Donald Trump fired Erika McEntarfer, former commissioner at the BLS. She was ousted after July jobs data came in lower than expected, and after major downward revisions to May and June jobs numbers. The latest BLS report also brought revisions — the July number was boosted by 6,000 to come in at 79,000, but June stands at a net loss of 13,000 after a downward revision of 27,000.

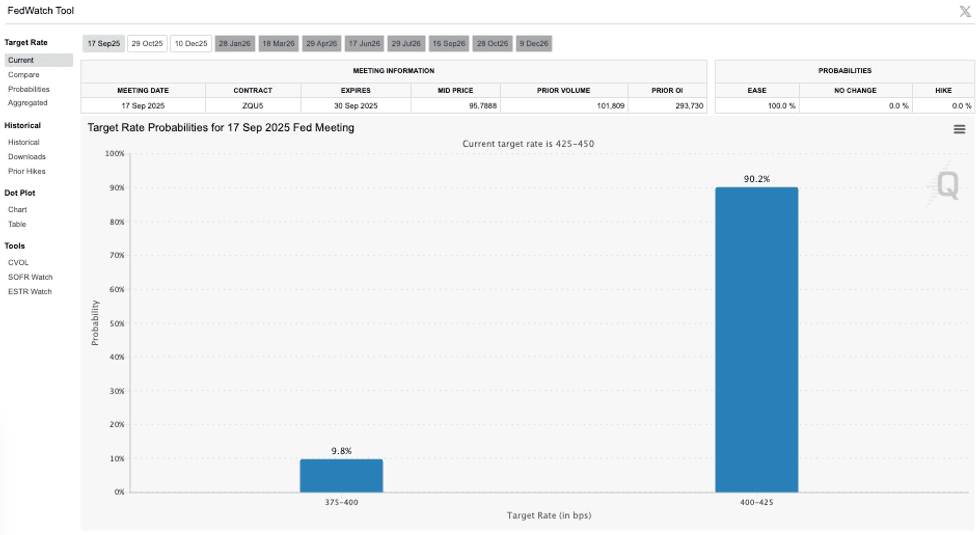

CME Group’s (NASDAQ:CME) FedWatch tool now shows a 90.2 percent probability of a 25 basis point rate cut in September, with a 9.8 percent probability of a 50 basis point reduction.

Target rate probabilities for September 17, 2025, Fed meeting.

Chart via CME Group.

Bond market turmoil also helped move the gold price this week.

Yields for 30 year US bonds rose to nearly 5 percent midway through the period, their highest level since mid-July, on the back of a variety of concerns, including tariffs, inflation and Fed independence.

Globally the situation was even more tumultuous, with 30 year UK bond yields reaching their highest point since 1998; meanwhile, 30 year bond yields for German, French and Dutch bonds rose to levels not seen since 2011.

In Japan, 30 year bond yields hit a record high.

Looking at gold’s path forward, experts agree that its prospects are bright, although what kicks off its next leg and how high it could go during this cycle remain to be seen. While rates are in focus as a key price mover right now, other potential drivers include a stock market correction and the return of western investors.

Watch six experts share their thoughts on gold’s next price trigger.

Elsewhere in the precious metals space, silver was trading at the US$41 per ounce level, down from its peak of around US$41.30 seen earlier in the week, but still at highs not seen since 2011.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

From Your Site Articles

Related Articles Around the Web