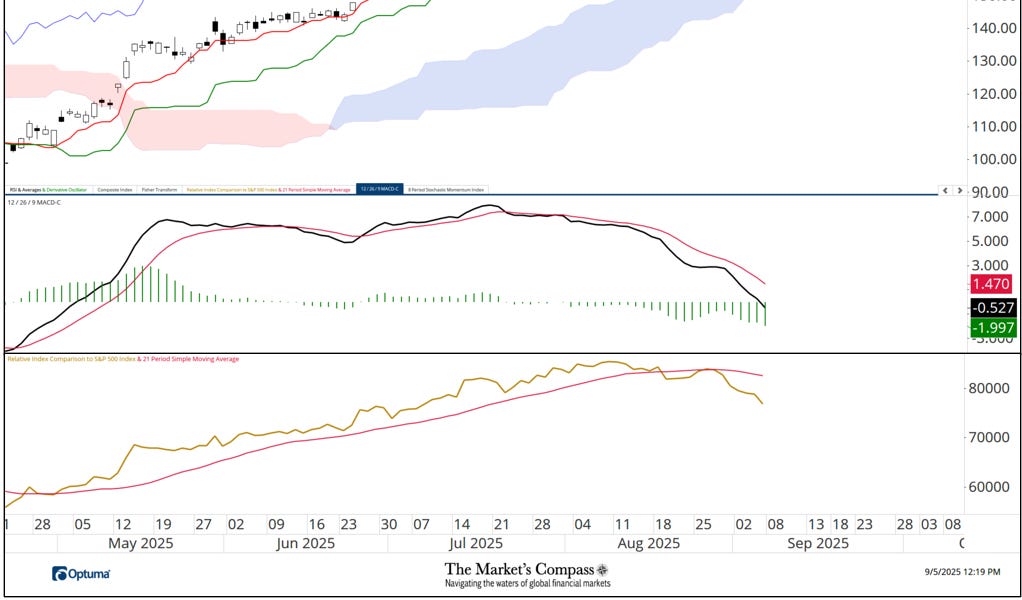

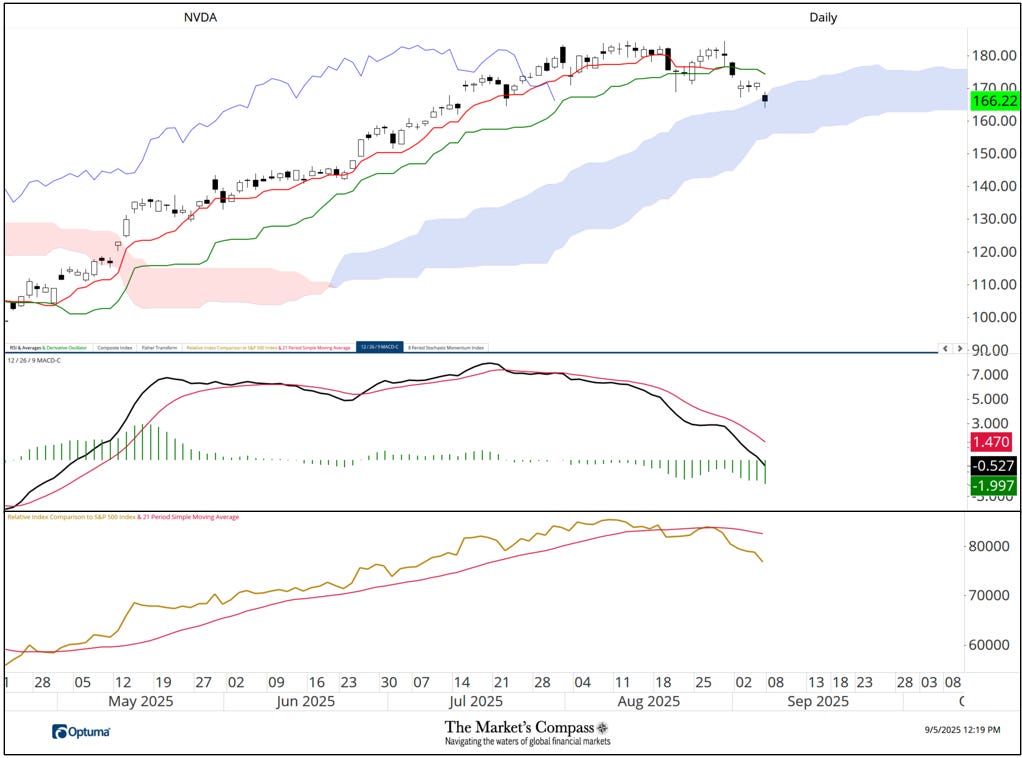

What follows is an expanded version of a tweet I posted to X on Wednesday August 27th prior to the much-awaited Nvidia’s earnings release and call after the market closed. I had stopped for a late breakfast at the River View Diner in Edgewater NJ on the west side of the Hudson River. The Diner is 30 years old and likely had a view of New York at one time, but it now is a misnomer with the massive construction in that area. There were two ancient men two booths away from me. They were griping about rising medical costs, Medicare, food prices and their “pain in the ass near death wives. Then one of them drops this gem: “Good thing I held on to my NVIDA after I sold my government bonds in April, I’m told earnings should crush it this afternoon, or so my grandson says, and he and his friends are long up the ass”.

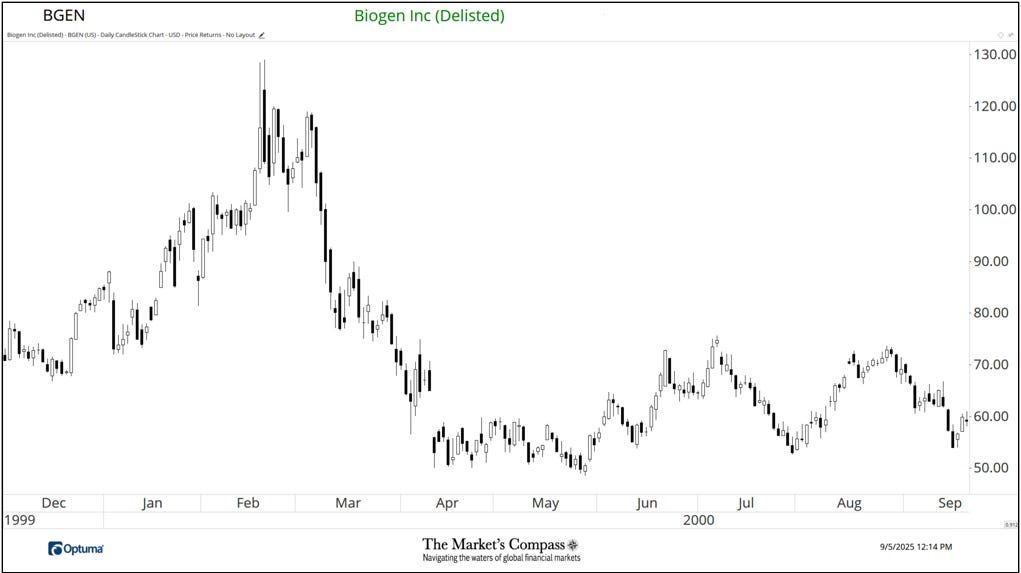

Hearing that reminded me of another incident back in 2000 when the burst in the Tech Bubble was just beginning to deflate. I had left my office on Broad Street after the close and walked down the steps to grab the #4 train uptown to meet clients. As I stood on the crowded platform waiting for the train, I overheard two young Brokers I recognized from Harry’s a few nights before chatting it up. “I sold my tech stocks” said one, “but I’m hanging onto my Biotech stocks”. “Yeah, I agree, they should weather the storm”. What these young bucks failed to consider was Biotech was just as over owned as Beenie Babies in the early 1990’s. Day’s later the CEO and I wrote a one-off published piece that discussed the crazy projected earnings and revenue assumptions that would follow and my technical concerns regarding several of them. The piece was picked up by Barrons and on Monday morning the phones lit up like Christmas trees. One client (who had sizeable Biotech position) screamed, YOU! No More Business for you. The chart below of Biogen shows what happened over the months that followed. I am not even being to say that my partner and I predicted or were responsible for the carnage that followed, only that when everyone owns it who’s left to buy? Very similar to when everyone at the cocktail party is touting something it’s best to run away.

Charts and price data are courtesy of Optuma.