We, too, should restore balance to our system, but inequality precludes an across-the-board increase.

Denmark recently raised its retirement age to 70 for Danes born in 1971 or later. Should we do the same thing? The answer is two-fold.

On the one hand, Congress should enact legislation to restore balance to our Social Security system, which faces a similar increase in costs in 10 years as Denmark does. Our benefits currently exceed our revenues, and the shortfall is covered by money in the trust fund. In 2033, the reserves in the trust fund will be exhausted and retirement benefits will be cut by 23 percent to match incoming revenues. To avoid such a large and abrupt benefit cut, Congress must enact a package that eliminates the program’s shortfall. And Congress should act sooner rather than later to relieve the anxiety of many older Americans and to distribute the burden in an equitable fashion among different cohorts.

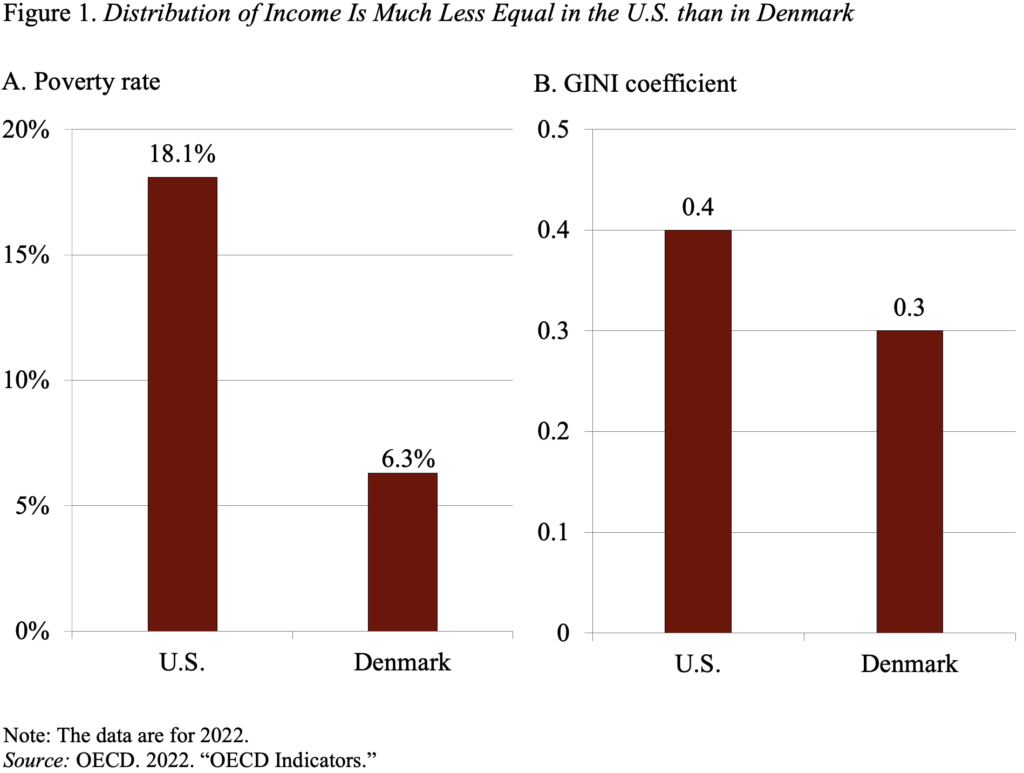

On the other hand, the U.S., unlike Denmark, is not in a position to enact an across-the-board increase in the retirement age, because we have a much more unequal society than Denmark. According to the OECD, the poverty rate in the U.S. is nearly three times higher than in Denmark, and a more comprehensive measure of inequality – the Gini coefficient — shows a much more unequal distribution of household income overall (see Figure 1). (A Gini coefficient of zero indicates that income is distributed equally among all households and a value of 1 indicates that one household receives all the income.)

The inequality in income translates directly into inequality in life expectancy. Remember the argument for a higher retirement age is based on the premise that people are living longer, so why not have them work longer. Yes, on average we have experienced gains in life expectancy, but those gains have been primarily enjoyed by the top half of the earnings distribution.

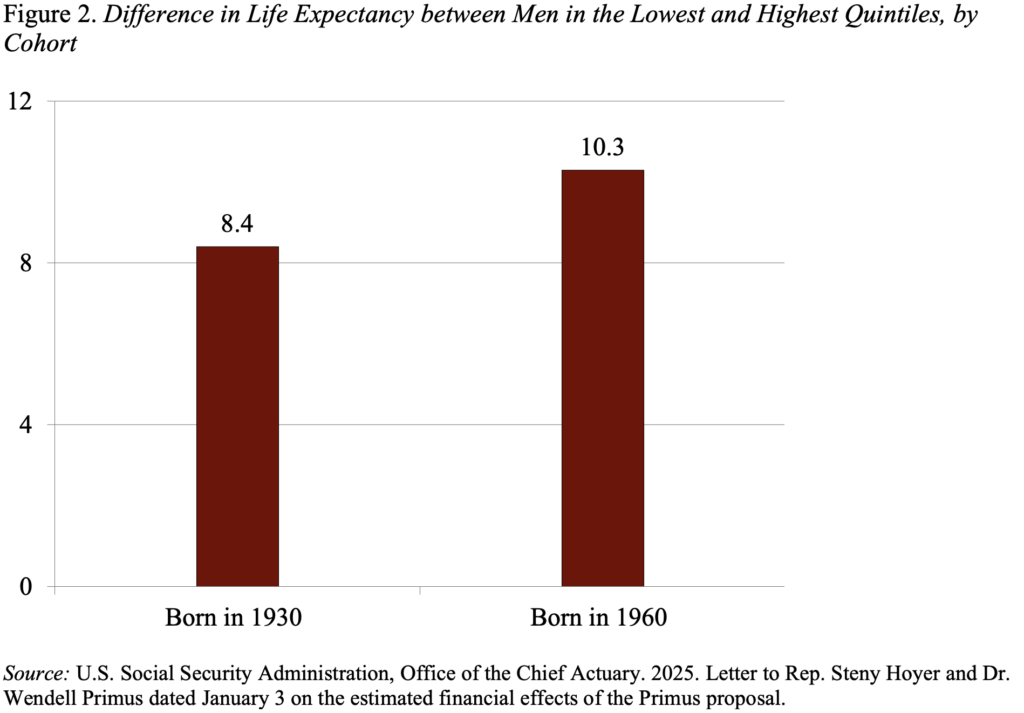

A recent study by the Social Security actuaries, which supports an extensive body of evidence, drives this point home in spades. For the record, the actuaries’ numbers probably understate the relationship between earnings and life expectancy for two reasons. First, these calculations exclude all workers who received benefits under the disability insurance program – a low-earning group with low life expectancy who would have reduced the bottom quintile estimate even more. Second, unlike earlier studies that looked at life expectancy at age 50, these numbers pertain to life expectancy at age 62; eliminating those who die between 50 and 62 produces a healthier group overall. Despite these biases, their analysis of all workers claiming retirement benefits showed that life expectancy rises systematically with earnings and the gap has been widening (see Table 1).

The results show that while life expectancy has increased overall from 18.1 years for men born in 1930 to 20.9 years for men born in 1960, the gains for the top 20 percent were more than twice as great as those for the bottom 20 percent, and the difference between the two groups increased so that men in the top now can be expected to live 10 years longer than men at the bottom (see Figure 2). That is, men in the bottom 20 percent of the earnings distribution are expected to live to about 77, whereas men in the top are projected to live to about 88.

Because of the huge discrepancy in life expectancy, commentators have proposed increasing the full retirement age only for those who could work longer. That is, only the top 20 percent of each cohort would work until 70, and the increase would be scaled so that low earners would retain the current retirement age of 67.

The bottom line is that Denmark’s increase in the retirement age reinforces the fact that we need to restore balance and confidence in our Social Security program. But the U.S. cannot adopt the same options as Denmark because life expectancy and the gains in life expectancy vary dramatically by earnings and our distribution of earnings is very unequal.