Municipal bonds often get painted with a broad brush stroke a lot of the time. Investors typically bundle these bonds together in a single package and think of them as a one-off allocation. A package that simply offers tax-free income. However, the municipal market is quite complex, with a variety of different securities, sub-asset classes, and features that investors can leverage at different times to boost returns.

One of them is callability.

A large subset of municipal bonds features a provision that allows states and other municipal entities to repay the bonds before their final maturity. And while that may seem like a hassle for investors, the win is a higher yield than a non-callability bond. For investors looking for higher income, this feature could be a real use.

Callability?

The “fixed” in fixed income comes from the idea that when you buy a bond, you’re lending an enterprise money for a set period. And over that time, you’ll receive an interest payment until the bond matures. It’s then that you’ll receive your original payment back- assuming the bond issuer doesn’t default. For many bonds- such as Treasury Securities- this is the case.

But not all bonds function this way.

Some have a feature that allows the issuer to redeem the bond before the stated maturity date. Sometimes, years or even decades before the bond is set to mature. This is called callability, and it functions like a call option on a stock. It gives the issuer the right, but not the obligation, to buy back the bond after certain conditions are met.

When a bond is called away, the issuer pays accrued interest on the bond and a final payment- usually the par value. The bond no longer exists, and the issuer no longer has to make further scheduled interest payments to investors.

For issuers, this is a big win because it lets them refinance debt at lower borrowing costs if yields/interest rates decline.

Munis & Callability

This feature has long been a characteristic of the municipal bond market, with its use varying over time. According to a fixed-income specialist at PIMCO, over the last ten years, roughly 83% of all municipal bonds issued have featured call options. Today, approximately 77% of the Bloomberg Municipal Bond Index features callable bonds. This is versus just 23% for the Bloomberg U.S. Aggregate Index and 0% for the Bloomberg U.S. Treasury Index.

Generally speaking, callable munis are longer-term securities in the 20-to-30-year range. The call option doesn’t kick in until year ten of existence, so it’s the back half (one or two decades) of the bond’s life that investors need to worry about the call happening.

As we said, the benefit for municipal issuers is that they can call their bonds when rates are lower to refinance and reduce their borrowing costs. But what is the benefit for investors? On the surface, buying a callable muni bond is a raw deal. After all, if yields/interest rates decline and the issuer redeems, then the bondholder will need to reinvest the proceeds at a lower yield.

The answer is that many investors simply demand more upfront yield when buying a callable bond. To compensate for the call risk, bondholders can typically pay a lower price for a callable bond versus one that does not include a call option. This allows callable bonds to yield more than their non-callable sisters. With that, investors can earn a higher income —potentially for a decade or more —until the call feature kicks in.

Secondly, investors can gain an advantage in terms of duration management.

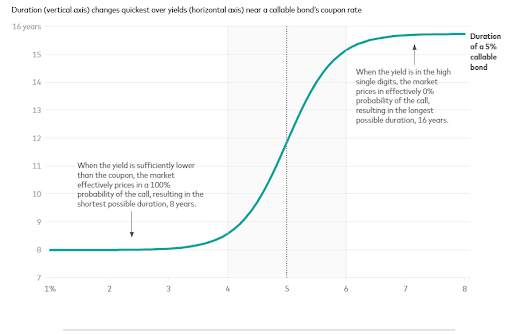

Duration is basically a measure of how much a bond will move when rates do. Longer-dated bonds generally have higher durations and will drop by more than those on the shorter end of the spectrum. Munis tend to be longer-dated bonds with longer durations. The beauty is that callable bonds have a more floating duration profile than non-callable ones. This chart from Vanguard shows a hypothetical 30-year callable bond with a coupon of 5% under different yield assumptions. As you can see, duration changes as interest/yield does.

Source: Vanguard

Because duration shifts lower, callable bonds tend to be less volatile and subject to fewer price changes than their non-callable rivals. That’s because investors now factor in the ability of the bond to be called at its par. You remove duration risk from the equation. This is particularly true when looking at two bonds- one callable and one not- from the same issuer. An example from Fidelity highlights two bonds issued by the state of Massachusetts that were both trading at around $110. During the 2022 interest rate tantrum, the callable bond fell by 9% because investors now predicted that the bond would be called. The non-callable issue declined by 27% to $80, reflecting its longer duration and lower starting yield.

Using Callability To Your Advantage

The key to callability and municipal bonds is the grey area- ironically enough, marked in grey on Vanguard’s chart. It’s here that investors don’t know if a bond will be called or not. Yields moving a little higher or lower than that probably won’t dampen its chances of being called much, so the impact on duration will likely be modest. That’s where an investor can lock in higher yields and better income prospects from callable munis.

You could do this yourself, run screeners at a brokerage account, and try to buy individual securities. However, this is a case for active management and ETFs. Many top muni managers take an active approach to callability. They effectively look for this grey area when buying or selling their bonds.

With that, by utilizing this callability feature, investors in an active muni ETF can mitigate some of the issues and potential downturns associated with a passive fund. This helps explain why active muni managers tend to outperform their benchmarks.

Active Municipal Bond ETFs

These ETFs were selected based on their ability to provide low-cost and active exposure to the municipal bond market. They are sorted by their YTD total return, which ranges from 0.5% to 1.8%. They have expense ratios ranging from 0.12% to 0.65% and assets under management of $127 million to $ 2.6 billion. They are currently yielding between 2.5% and 4.4%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| SHYM | iShares High Yield Muni Income Active ETF | $295M | 1.8% | 4.4% | 0.46% | ETF | Yes |

| IMNU | iShares Intermediate Muni Income Active ETF | 244M | 1.5% | 3.6% | 0.41% | ETF | Yes |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1.75B | 1.4% | 3.2% | 0.35% | ETF | Yes |

| CGMU | Capital Group Municipal Income ETF | $2.59B | 1.4% | 3.4% | 0.27% | ETF | Yes |

| SMMU | PIMCO Short Term Municipal Bond Active ETF | $630M | 1.2% | 2.9% | 0.35% | ETF | Yes |

| MEAR | iShares Short Maturity Municipal Bond Active ETF | $733M | 1% | 3.1% | 0.25% | ETF | Yes |

| VCRM | Vanguard Core Tax-Exempt Bond ETF | $127M | 0.9% | 3% | 0.12% | ETF | Yes |

| FMB | First Trust Managed Municipal ETF | $2.04B | 0.8% | 3.3% | 0.65% | ETF | Yes |

| DFNM | Dimensional National Municipal Bond ETF | $1.42B | 0.8% | 2.5% | 0.19% | ETF | Yes |

| TAXF | American Century Diversified Municipal Bond ETF | $508M | 0.5% | 3.6% | 0.29% | ETF | Yes |

While many fixed-income sectors don’t have to worry about callability, this feature can be exploited in the municipal bond market. On the surface, it may seem like a bad thing, but investors can win out on initial yield and duration management when selecting a callable bond. And while it’s possible to do this yourself, focusing on callability is one area where it pays to go with a professional. Using an active ETF of a mutual fund makes a lot of sense in the muni bond space.

Bottom Line

Almost all bonds last until they mature. Municipal bond investors can exploit this callability feature to boost yield and reduce their duration. This is a big win versus passive indexing in the space.