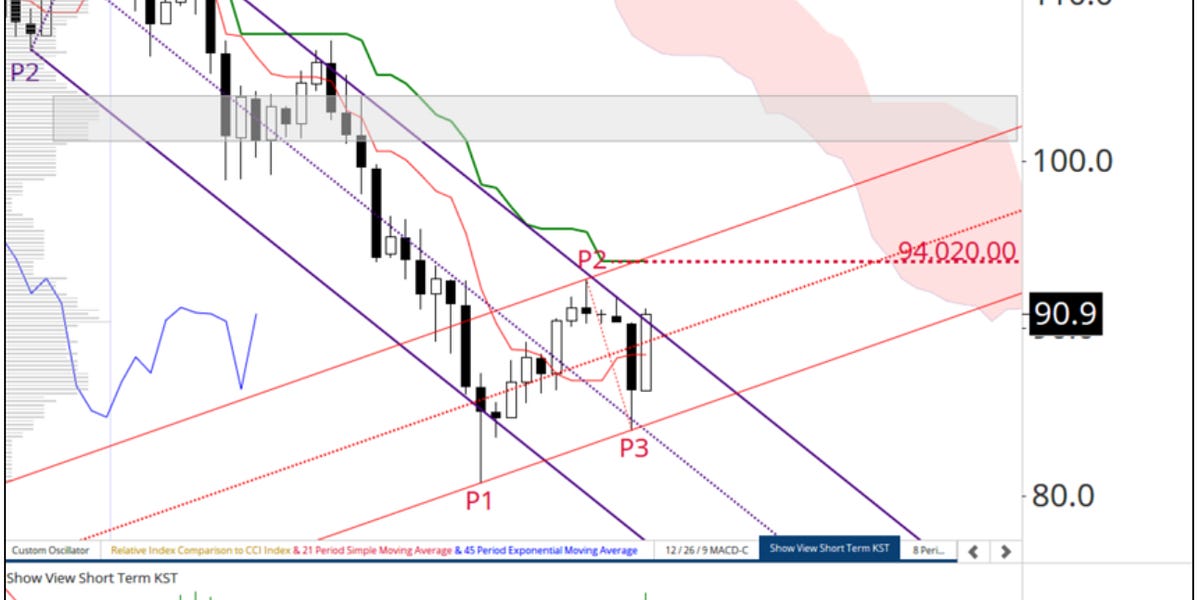

The trading day is not over, but it appears to me that Bitcoin has survived yesterday’s “bear attack”. After rebounding from support offered by the Median Line (violet dotted line) of the Standard Pitchfork (violet P1-P3) to close yesterday at a higher low, Bitcoin has rallied today and is challenging the Upper Parallel (solid violet line).

Pring’s Know Sure Thing or KST* in the lower panel turned up through its signal line three days ago.

*KST is a momentum oscillator by Martin Pring that is a weighted sum of four different rate of change, or ROC, indicators with each using different smoothing periods to come up with a composite momentum indicator. The signal line is a simple moving average of the KST line. I have shortened the four ROC indicators for use in shorter time frames. KST is not an overbought / oversold indicator, it is a trend identifying indicator.

I have added a second shorter-term Schiff Modified Pitchfork (red P1-P3) this morning. A close above the Upper Parallel of the longer-term Pitchfork would suggest that the Kijun Plot (green line) and the Upper Parallel (solid red line) of the newly drawn Pitchfork will easily be challenged. Above that there is nothing but blue sky until the cluster of price activity highlighted with the grey rectangle. Thus far it appears that the low on November 21st was the end of the corrective phase from the early October closing high. Key support is at yesterday’s intraday low at 84,000 needs to hold, for the above technical thesis to remain intact.

An in-depth comprehensive lesson on Pitchforks and analysis as well as a basic tutorial on the Tools of Technical Analysis is available on my website…