December 16, 2025 – SALT LAKE CITY – Canopy, the leading all-in-one practice management platform for accounting firms, today announced two major additions to its software suite: Capacity Planning and Engagement Packages. Together, these new capabilities give firms clearer visibility into workloads, more control over pricing and scope, and greater confidence in how they deliver and scale their services.

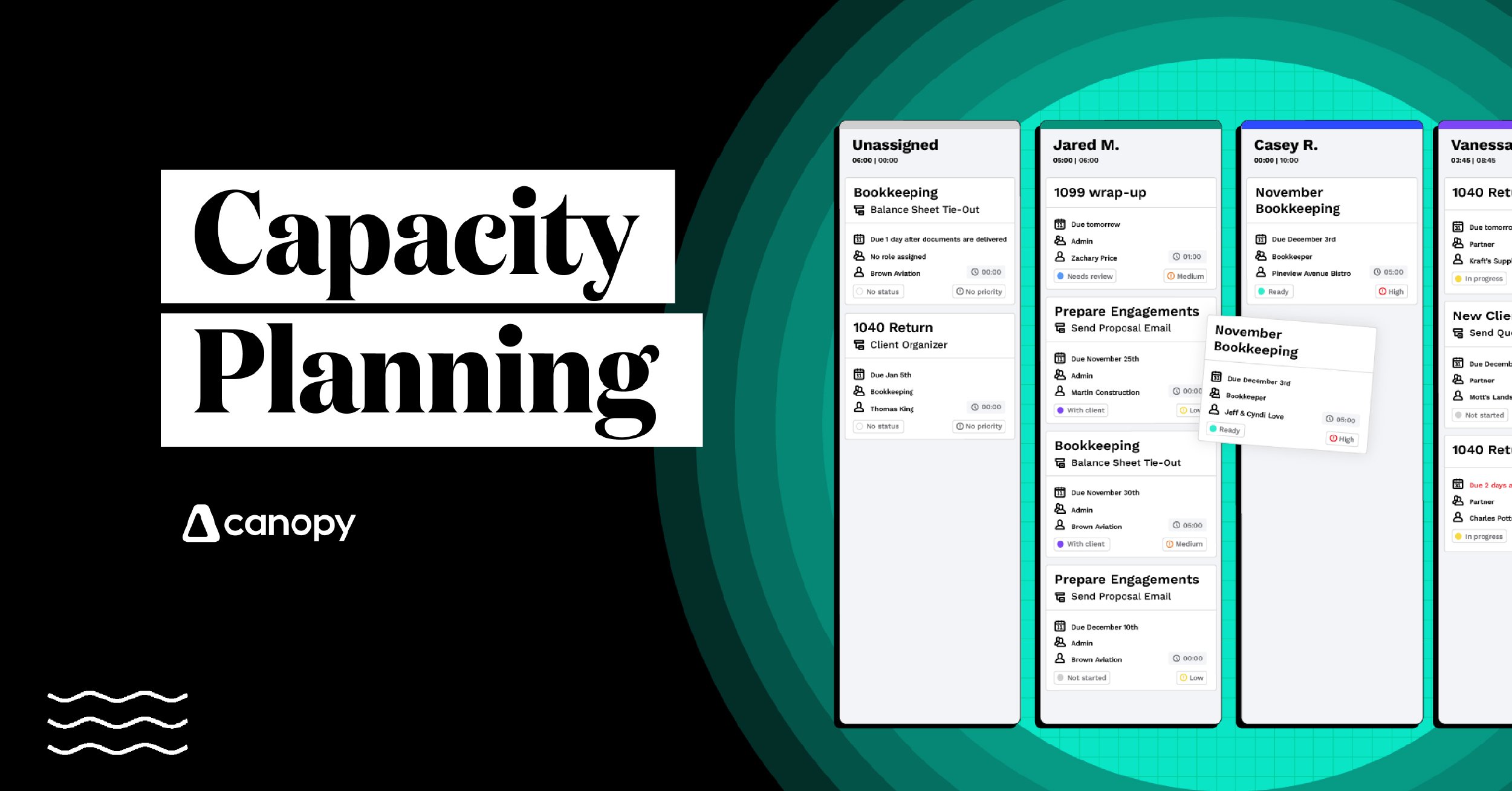

Capacity Planning provides instant visibility into team workloads so firms can rebalance assignments in seconds and keep projects moving. With a drag-and-drop board view built directly into Canopy Workflow, firm leaders can quickly see who is over capacity or underutilized and adjust workloads without switching tools. The result is a more sustainable pace of work, reduced burnout, fewer bottlenecks, and more predictable delivery—without spreadsheets or guesswork.

Engagement Packages enable firms to price confidently, protect margins, and elevate the client experience. Using a proven three-tier model—good, better, best—firms can better align services to client needs, increase average revenue per engagement by 20-30%, and avoid scope creep. When paired with templates and automated workflows in Canopy, engagement packages help firms turn client agreements into scalable, repeatable revenue streams.

“These additions strengthen the core of what firms rely on us for: clarity, efficiency, and confidence,” said Canopy VP of Product Hanna Bjornn. “Capacity Planning helps leaders make better decisions in real time, while Engagement Packages give firms a more structured and profitable way to deliver work. Both capabilities are designed to remove friction from firm operations so accountants can stay focused on serving clients.”

The launch builds on Canopy’s continued investment in expanding and modernizing the firm-wide operating system used by thousands of accounting teams. With Capacity Planning and Engagement Packages now integrated directly into the platform, firms can better manage the full lifecycle of work—from scoping and pricing to assignment and completion—in one place.

Both new capabilities are available today to Canopy customers. To learn more, visit getcanopy.com.

About Canopy

Canopy is an award-winning, all-in-one practice management platform for accounting firms. The platform provides a suite of integrated modules–including CRM, workflow, document management, time & billing, and payments–designed to streamline firm operations and improve the client experience. Canopy is SOC2 certified and committed to data security. Learn more at getcanopy.com.

Media Contact:

Chad Saley

Director of Content

media@getcanopy.com