Part of the recently passed tax bill includes what the administration is calling “No Tax on Social Security.” The bill does not directly remove taxes on Social Security payments, but it does provide an additional deduction for seniors under certain income limits. This provision may effectively reduce – or, in some cases, even eliminate – federal taxes paid by people ages 65+.

First of all, it should be noted that this tax break worsens the tenuous fiscal condition of Social Security. Social Security actuaries estimate that the new tax provisions will move up the trust fund depletion date by roughly six months – from the 3rd quarter to the 1st quarter of 2034.

Nevertheless, current beneficiaries will see the benefits of lower taxes. This blog post looks at how the new deduction works and how it may impact your federal income taxes.

How Deductions Work

To understand the mechanics of this new tax break, it helps to know how deductions work. The following is a simplified explanation of the standard deduction (this is not tax advice).

You start with gross income, which is the total of all sources of taxable income. This amount typically includes work income, most pensions, taxable investment income, and up to 85 percent of your Social Security income. The taxable share of your Social Security is based on what is called “combined income,” which equals half of your Social Security benefit, plus nontaxable interest, plus all other taxable income. Once combined income is greater than $44,000 for married couples filing jointly or greater than $34,000 for single filers, 85 percent of Social Security benefits are taxable. (At lower thresholds, people are taxed on up to 50 percent of their benefit income; below these thresholds, benefits are not taxed at all.)

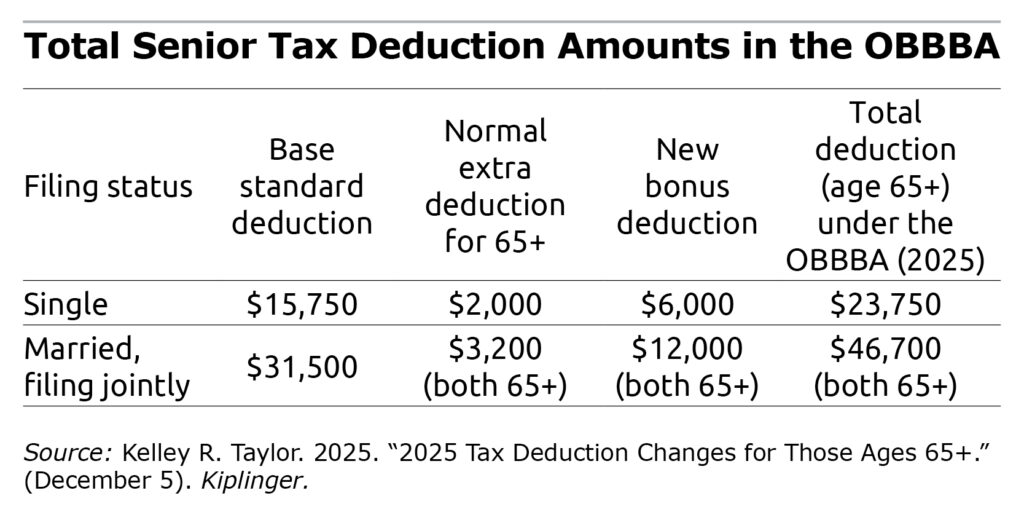

After totaling your gross income, including taxable Social Security, you subtract deductions. You have the option of tallying up individual items and itemizing deductions, but most people do better by taking the standard deduction. People ages 65+ also receive an extra standard deduction. The new tax bill adds to this already increased standard deduction, bringing the total to $23,750 for singles and up to $46,700 for married couples filing jointly (see Table). It is worth noting that this new deduction is temporary – it is available from 2025 through 2028. This potentially whopping standard deduction is then subtracted from gross income to arrive at taxable income.

Impact of the New Provision

The new provision doesn’t explicitly remove federal taxes on Social Security, but it does have the same effect for many people, reducing taxable income by $6,000 per person for those ages 65+. For lower-income retirees who are reliant on Social Security, this might be enough to all but eliminate their entire federal income tax liability. Note, though, that lower-income households below certain thresholds were already untaxed on Social Security. For these households, the additional deduction will reduce other taxable income.

Let’s look at how this might impact income taxes. Take a single woman over age 65. Say she receives a taxable pension of $30,000, investment income of $10,000, and Social Security benefits of $24,000 (85 percent of which is taxable). That puts her in the 12-percent federal tax bracket. Incorporating the new $6,000 tax provision will effectively reduce her federal tax bill by $720.

Pay Attention to Income

An important caveat to this new provision is that it is phased out for single taxpayers with incomes over $75,000 and married filers with incomes over $150,000. The phaseout is $60 for each $1,000 over the threshold. It is fully phased out at $175,000 for single filers and $250,000 for joint filers.

Bigger Refunds in 2026

Although the new tax provision does not explicitly eliminate taxes on Social Security, it will reduce taxes for many filers age 65+. If you’ve paid estimated taxes throughout the year or had taxes withheld on your income, you may end up getting a bigger refund (or owe less) in 2026.

Luke Delorme, CFP® is Director of Financial Planning at Tableaux Wealth in Great Barrington, MA (www.tableauxwealth.com), reachable at luke@tableauxwealth.com. To stay current on the Squared Away blog, join our free email list.

This blog post is for informational and educational purposes only and should not be considered financial advice. Consult a qualified professional for advice specific to your situation.