A lot of people don’t realize this, but you could own a mutual fund, have losses on that fund, and STILL have to pay major capital gains taxes…say what?! (Article from Russell.)

Morningstar has an annual report that covers some particularly big distributions, and usually there are fund distributing 20, 40% or more!

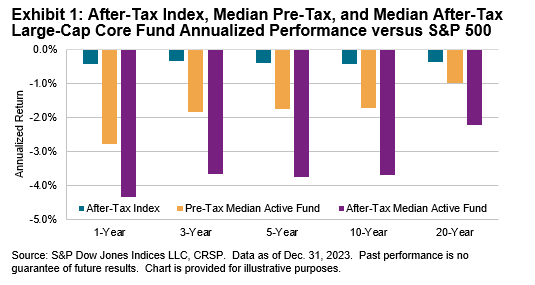

Here is a table from S&P that demonstrates the tax drag for investors…one could make the argument that owning high fee tax inefficient mutual funds in a taxable client account is malpractice.