October 09, 2025

Older Enrollees and Patients Living in Red States Will Be Hurt Most If ACA Subsidies Lapse

Americans between the ages of 50 and 64 and those living in Republican congressional districts will be the hardest hit if the current Affordable Care Act tax credits are not renewed by Congress, according to new analyses from KFF.

The tax credits expanded eligibility for subsidies so that more middle-income Americans could get help paying health insurance premiums. Fifty-one percent of these enrollees are 50 to 64 years old. They are not eligible for Medicare and do not have health insurance through their employment. Since insurers are already allowed to charge older patients up to three times as much for ACA plans, if subsidies expire, this group would be hit with a “double whammy,” where they could no longer get help paying for premiums but also would face the steepest increases.

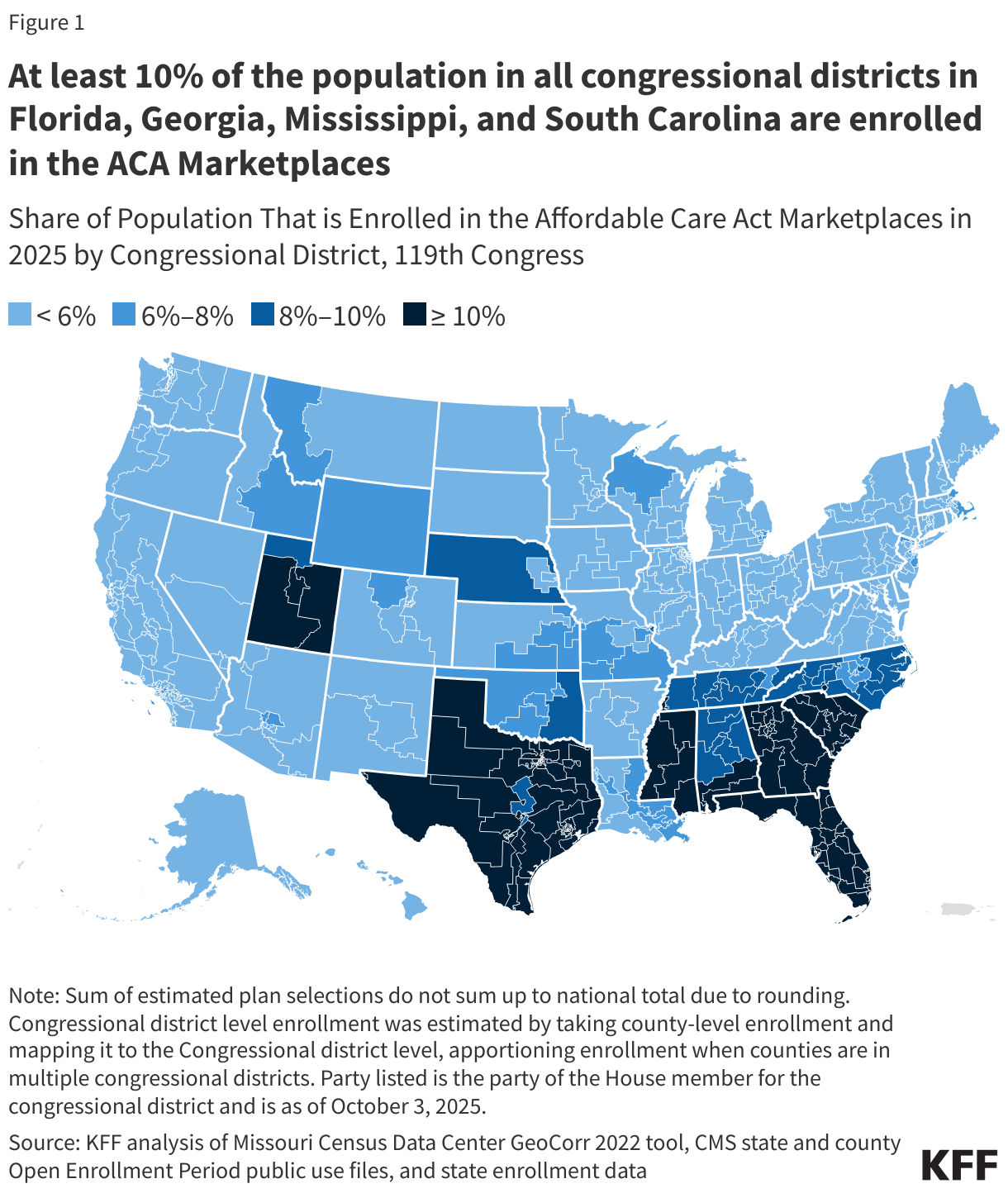

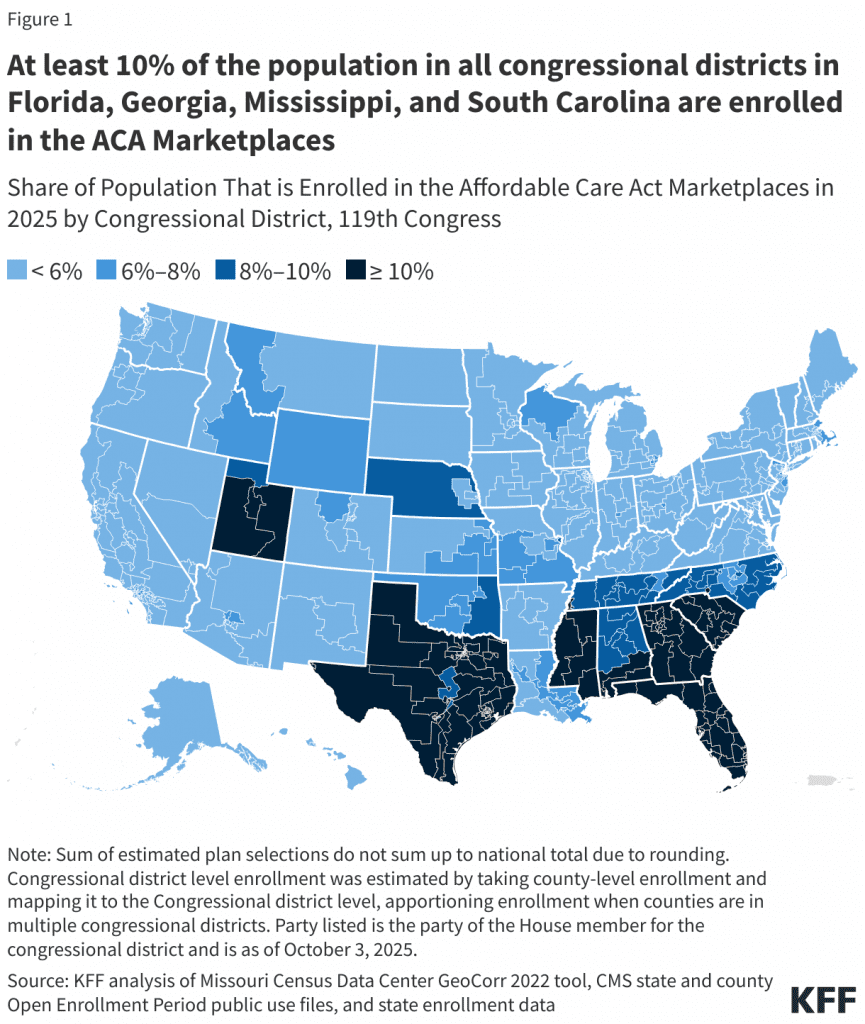

Americans living in states that have not expanded Medicaid or have high rates of uninsured and/or low-income residents are also more likely to be enrolled in an ACA Marketplace plan and take advantage of subsidized coverage. More than half of ACA enrollees live in Republican congressional districts, especially in Southern states. At least 10 percent of residents in every congressional district in Florida, Georgia, Mississippi, and South Carolina are enrolled in a Marketplace plan.

Americans living in states that have not expanded Medicaid or have high rates of uninsured and/or low-income residents are also more likely to be enrolled in an ACA Marketplace plan and take advantage of subsidized coverage. More than half of ACA enrollees live in Republican congressional districts, especially in Southern states. At least 10 percent of residents in every congressional district in Florida, Georgia, Mississippi, and South Carolina are enrolled in a Marketplace plan.

The five congressional districts with the most ACA enrollees are all in Florida: FL-27, FL-24, FL-28, FL-09, and FL-26. At least 30% of residents in each of these districts are enrolled in an ACA plan.

The ACA tax credits will expire on December 31, 2025. If Congress does not take action, on January 1, health insurance premiums will skyrocket by as much as 114 percent for 22 million Americans who rely on ACA Marketplace plans. Democrats attempted to get an extension included in a government funding bill last week, but Republicans pushed a “clean” bill that would keep spending at previous levels for seven weeks instead.